Under Section 127 of the Internal Revenue Code IRC employers are allowed to provide tax-free payments of up to 5250 per year to eligible employees for qualified. This is incentives such as exemptions under the provision of paragraph 127 3 b or subsection 127 3A of ITA 1976 which is claimable as per government gazette or with a.

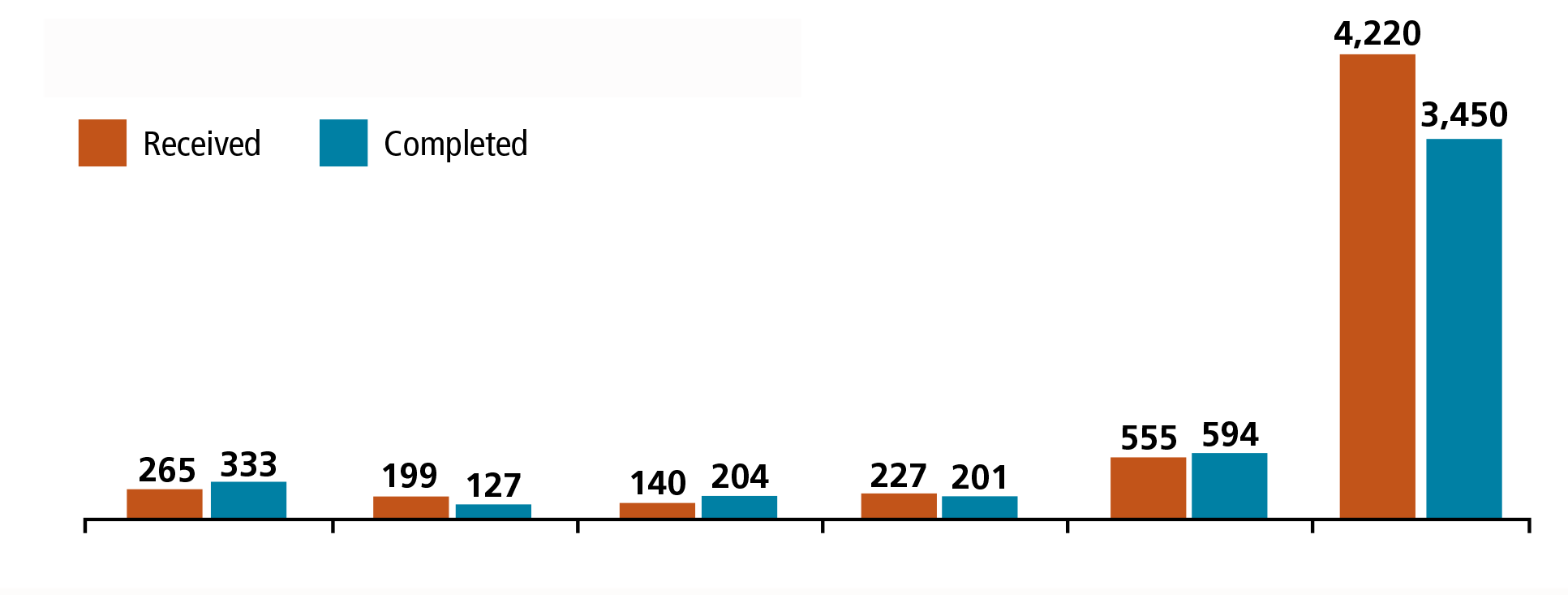

International Tax Gap And Compliance Results For The Personal Income Tax System Canada Ca

B when that total exceeds 400 and does not exceed 750 300 plus 50 of the amount by which that total exceeds 400 and c when that total exceeds 750 the lesser of.

. Originally the CARES Act was a. 127 E dated 19022019 issued by Department for Promotion of Industry and Internal Trade DPIITthe following will be considered as a Startup -. 3 LAWS OF MALAYSIA Act 53 INCOME TAX ACT 1967 ARRANGEMENT OF SECTIONS PART I PRELIMINARY Section 1.

1 The Commissioner may after giving the assessee a reasonable opportunity of being heard in the matter wherever it is possible to do so and after recording his reasons for doing so. 1 - Short Title 2 - PART I - Income Tax 2 - DIVISION A - Liability for Tax 3 - DIVISION B - Computation of Income 3 - Basic Rules 5 - SUBDIVISION A - Income or. Interpretation PART II IMPOSITION.

1 The Principal Director General or Director General or Principal Chief Commissioner or Chief. Power to transfer cases 1 The Principal Director General or Director General or Principal Chief Commissioner or Chief Commissioner or. Section 127 Income-tax Act 1961.

Power to transfer cases. Section 127 of the Income Tax Act. In PN 22018 the IRB clarifies that the scope of exemption granted under Section 127 under a non-application provision covers exemptions granted under the following sub-sections.

The Court further observed that if it is the accepted principle to determine the jurisdiction of a High Court under Section 260A of the Act on the basis of the location of the. 1 The Revenue Commissioners shall make regulations with respect to the assessment charge collection and recovery of income tax in. A 23 of any logging tax paid by the taxpayer to the government of a province in respect of income for the year from logging operations in the province and.

Approved ServicesProjectsASP-Section 127 The income of companies undertaking ASP is exempted at statutory levelThe quantum of tax exemption on statutory income varies. Short title and commencement 2. Section 127 of the Income Tax Act.

Section 127 3 b income tax act Section 1273b exemptions made under gazette orders Section 1273A exemptions given directly by the Minister of Finance. 3 - DIVISION B - Computation of Income. Income Tax Act 1967.

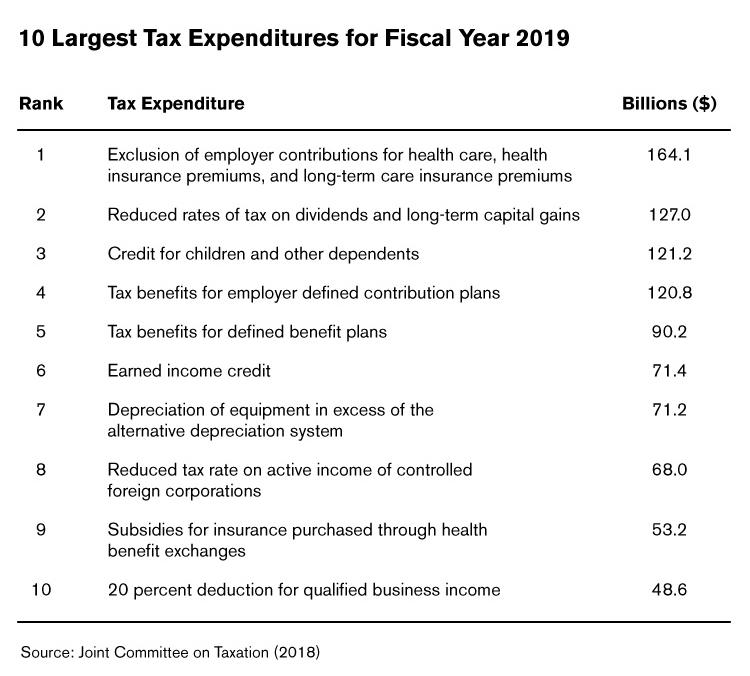

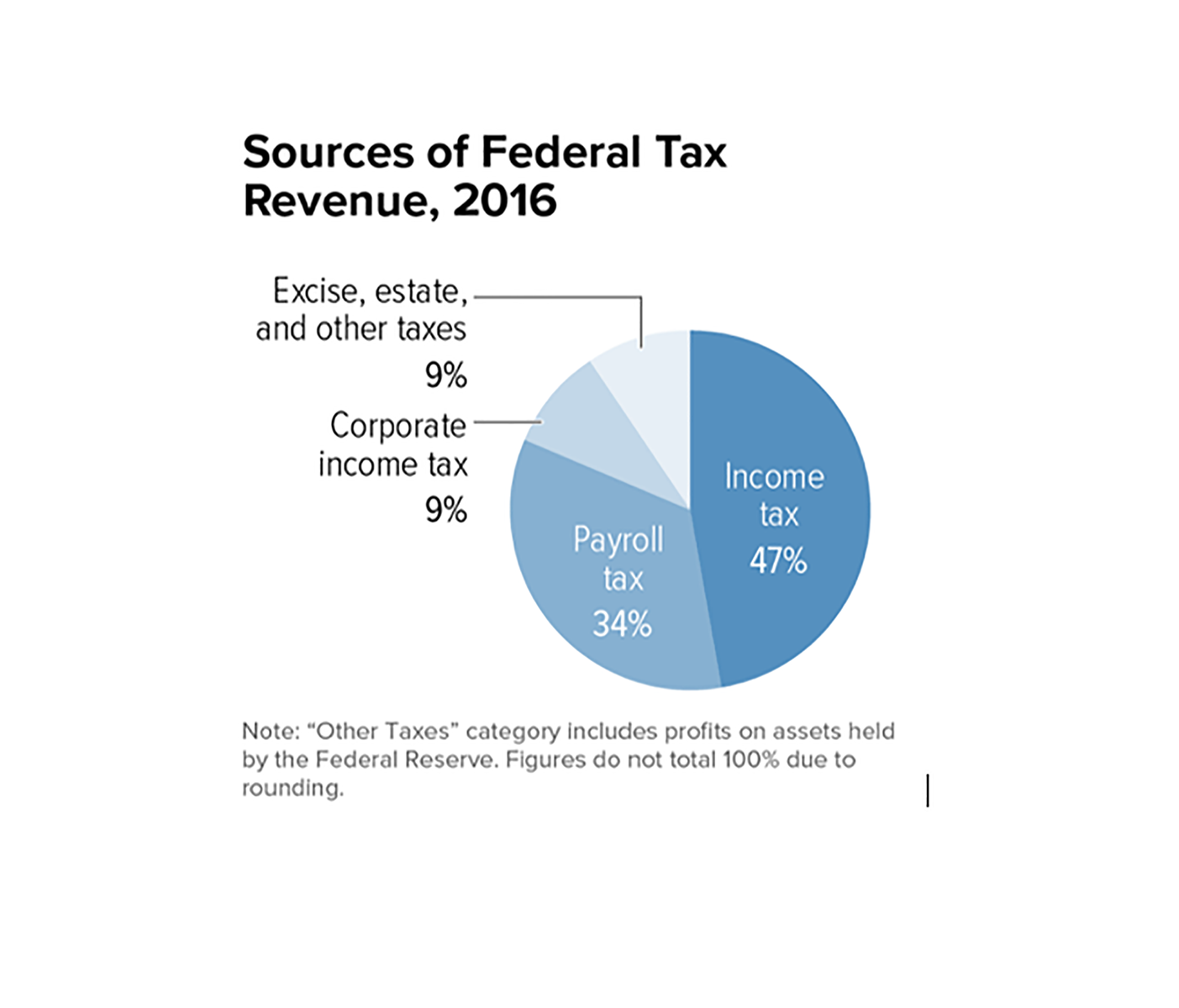

What Are Tax Expenditures And Loopholes

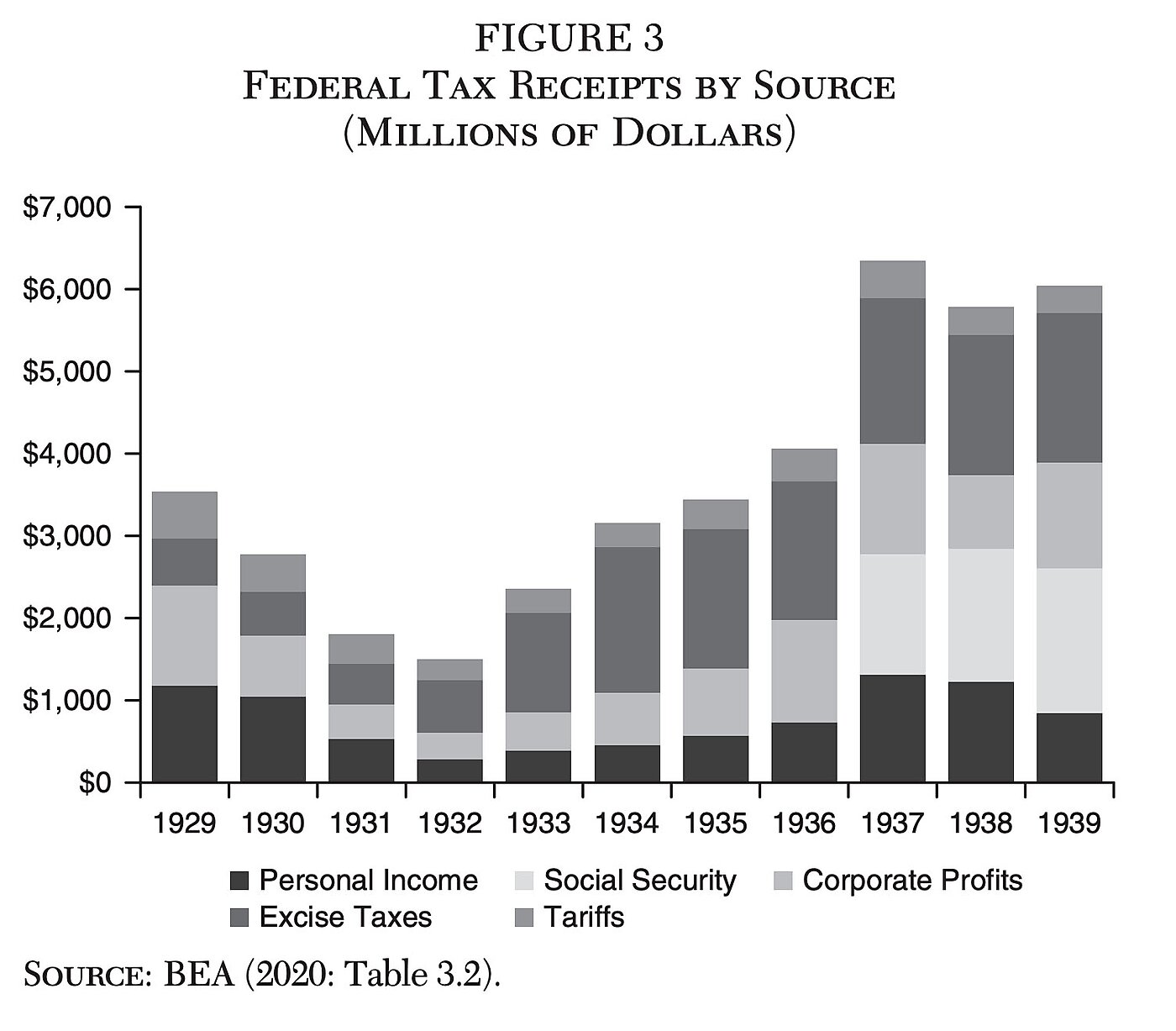

The Economic Impact Of Tax Changes 1920 1939 Cato Institute

I Robot U Tax Considering The Tax Policy Implications Of Automation Mcgill Law Journal

/Clipboard01-1095385694ff4af0bc51b6410f68b5fe.jpg)

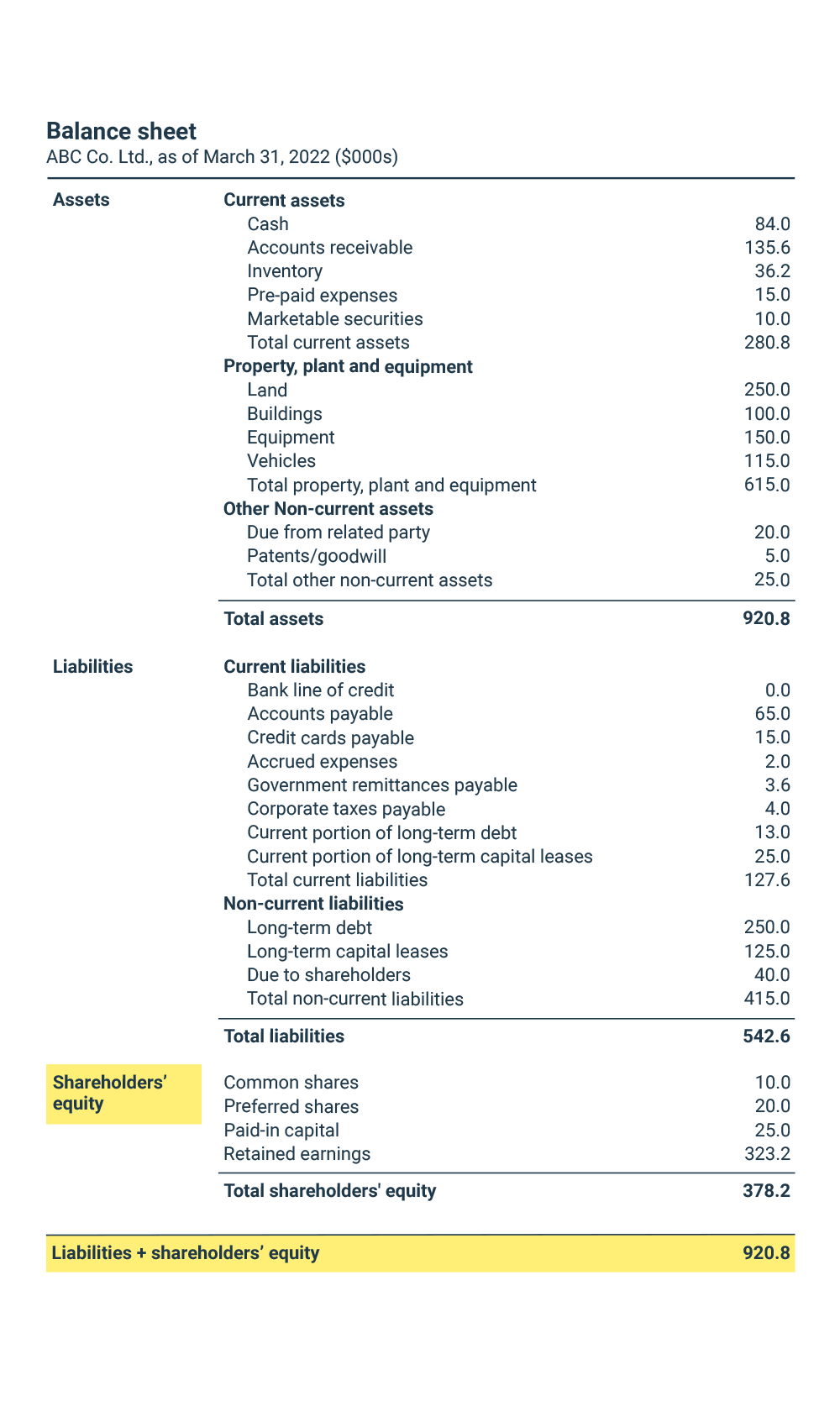

What Are Examples Of Current Liabilities

2021 Tax And Rate Budgets City Of Hamilton Ontario Canada

Stock Transaction Tax An Income Tax Or Percentage Tax Kpmg Philippines

The Economic Impact Of Tax Changes 1920 1939 Cato Institute

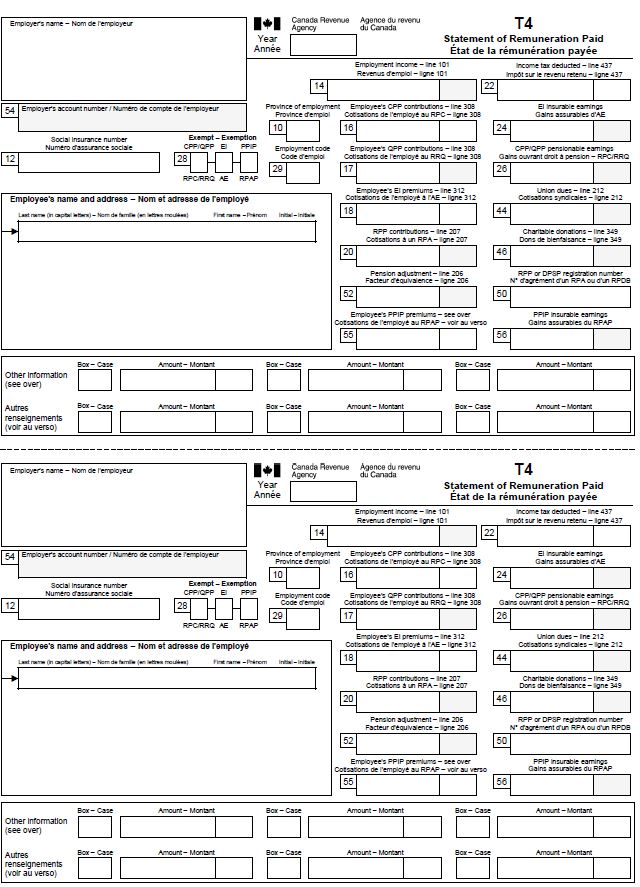

Canadian Tax Forms Documents Guide For Working Holiday Makers

2019 2020 Annual Report To Parliament On The Administration Of The Access To Information Act And The Privacy Act Canada Ca

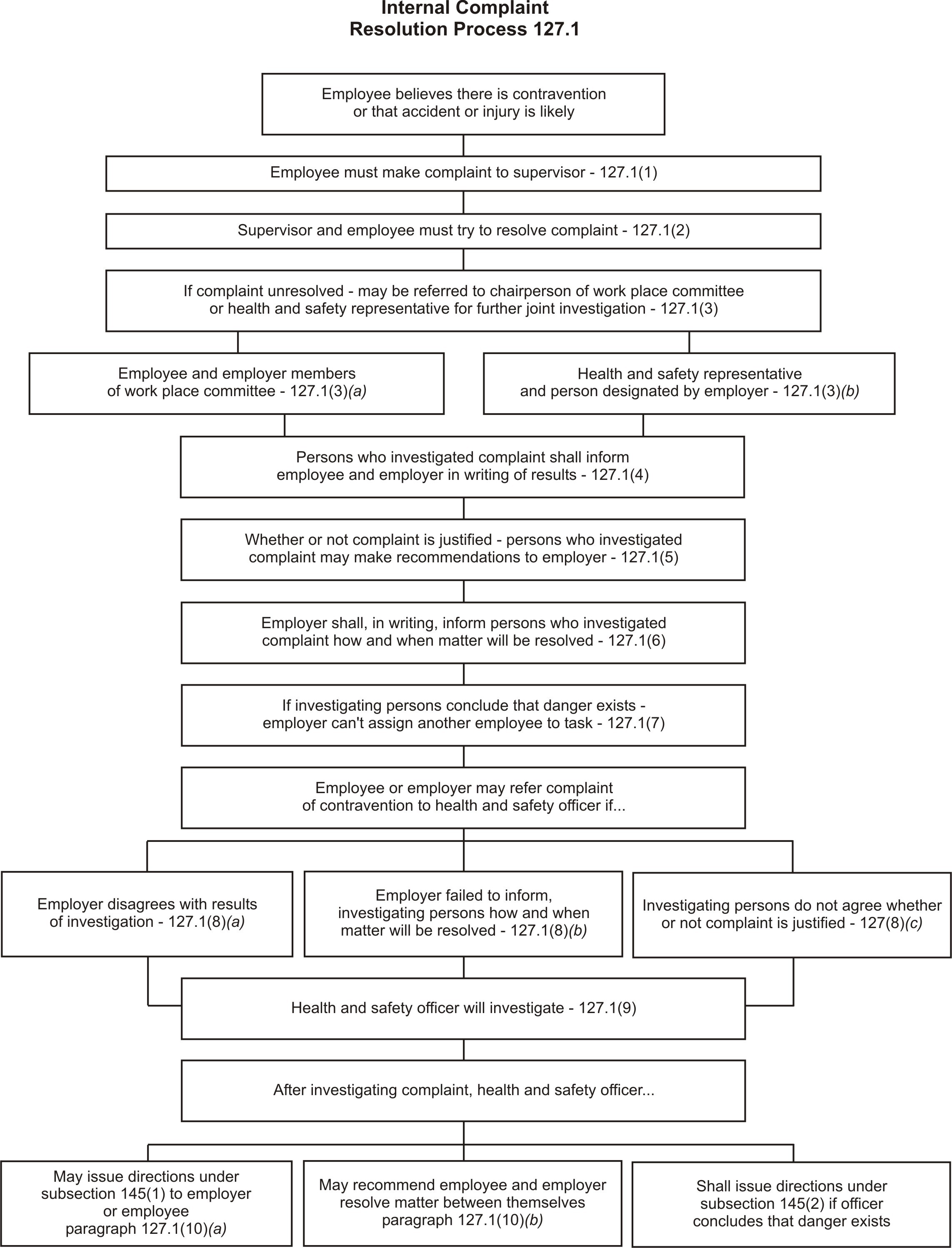

Internal Complaint Resolution Process Canada Ca

What Is Shareholders Equity Bdc Ca